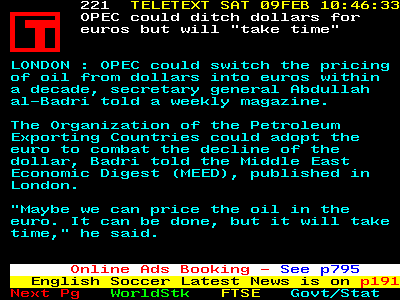

As you can read from the TELETEXT the future of the US Dollar is going to be a bearish trend. I don't have any figure on how much US printed the Dollar notes in this world, but there is economist that ever mention US itself only hold 20% and the rest of the countries holding 80% of the US Dollars if they are all added together it will be roughly around a Tens of Trillions of US Dollars, I just guess only... (There is no document can proof how much they have printed.)

Will there a trend of untie the Dollar with their products? Just like what the OPEC is going to do.

This is a unstoppable trend for those people to do as what OPEC does, because they also don't want their value to get weaker. So if this trend get stronger, people might avoid Dollar more often and the Dollar will be getting even weaker.

Most of the Market tie with Dollar, example Oil (US$/barrel), gold (US$/Kg), metals and other more commodities. Why US want to do in this way, this is because the more consumer want the commodity they have to sell their currency to buy Dollar for the commodity that they wanted to buy. This will be talk in Foreign Exchange (Forex), example 1 US Dollar buy 120 Japanese Yen that is last time rate, now the rate is 1 US Dollar buy 107 Japanese Yen, this mean the US Dollar is getting weaker and the Japanese Yen is getting stronger.

Weaker currency will have their advantage and disadvantage. The Advantage is the exporting trade will get strong as the goods for US is getting cheaper so consumer from other countries buy more. For the Disadvantage is weaker dollar cannot curb the high inflation. This all will be talk in economic study in degree course.

If US Dollar want to be strong again, US Govt. will have to put more productivity in their high end / high value export, cut down the most of their Govt. spending, regain the strong Dollar diplomat by asking other countries currency to tie with Dollar for not to sell Dollar (also by Exchange other things). once US govt. have the more money they will have to buy back their debts fast to keep their Dollar strong.

This Year US GDP is expected below 2%, many of the economist is expected to see this to be happen even the US economy will no fall into recession as what the US President and Fed expected for the 2008 US economy.

All this will depend on the new US Govt. to defence for their Strong Dollar policy. Question now is Who will be the next US Govt....?

Reference:-

United States public debt

NOTE: This Article is just for a prediction only, the trend of the currency itself will be change by time to time when the Central Bank intervation the Markets, Monetary Policy and others more.