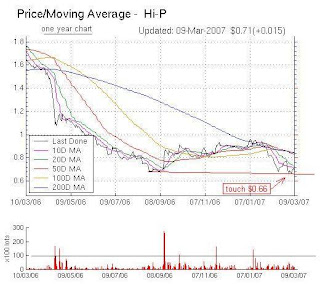

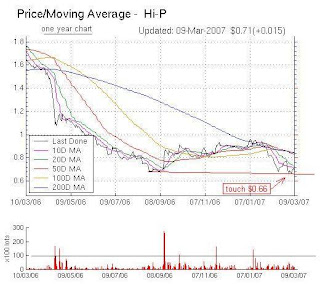

Recently Suisse have upgraded HI-P International Ltd from "underperform"to "outperform"

with a target of $0.93

On the other side HI-P International Ltd hope that earnings will recover this year.

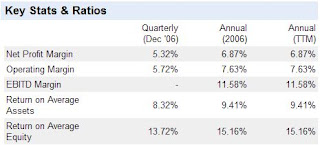

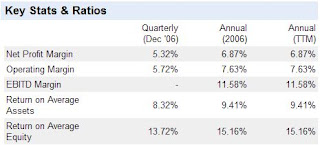

Hi-P International Ltd net profit for last year slumped 35.5% to S$57 millions as margins were

pressured by the higher material content of its product mix, higher staff costs

and excess capacity. The higher material is a main concern on higher crude oil price.

Plastic is a material that made by crude oil, tool steel that they used in making tools for plastic injection mould and others that needed steel material that are used the higher steel price.

The process of making plastic injection mould required some EDM process to form the complex profile of the plastic part required. most common used of electrode in EDM are copper which the price of copper have goes up a lot. Copper are in the demand that cause by lack of supply, mined copper supply are way behind the copper demand that are one of the reason that cause higher in price. The copper mine are getting hard to find in the world, supplying of copper are believe to be remain tight in the coming years if there is no solution on increasing the supply. recycle of copper does help to cool down the demand by a bit but it will not last long as China and india are continous to growing and developing.

if the crude oil price and copper price can slight down by increase the supply HI-P International Ltd may benefit from it. Govt. Tax cut may help HI-P International Ltd a little but will not last long in the long term business. They may have to change their overall business strategy to place themselve in a most benefit way. Will the increase of GST help HI-P International Ltd in their business?

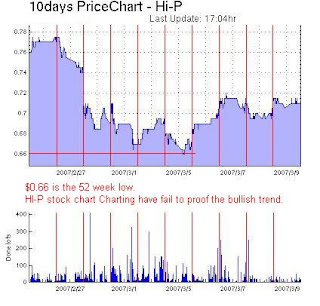

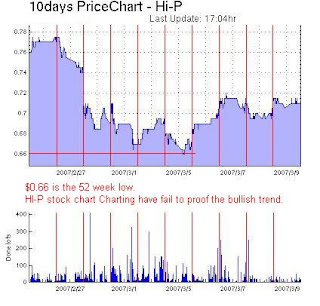

So what can HI-P International Ltd promise their investors that the stock price will goes up? hoping to see a recover? Think about it first...

AUDITORS

Ernst & Young

BACKGROUND

The Company was incorporated in Singapore on 26 December 1980 under the name of Hi-P Tool & Die Pte Ltd. It changed the name to Hi-P Singapore Pte Ltd on 5 February 1997 and subsequently to Hi-P International Pte Ltd on 12 October 2000. It adopts its current name on 10 October 2003.Hi-P is an integrated contract manufacturing services provider specialising in precision plastic injection molding, mold design and fabrication, assembly, surface finishing and precision metal stamping. It provides turnkey contract manufacturing services to its customers in the consumer electronics & electrical industry. Its customers are mainly multi-national original equipment manufacturers in:• Telecommunications• Consumer electronics & electrical• Data storage• Life sciences / medical• AutomotiveIts principal markets include China, Singapore, USA and Europe. Its customers' end products include mobile phones, razors, electric toothbrushes, electric shavers, hairdryers, cameras (digital, reloadable and disposable), hard disk drives and medical devices.Some of its major customers include Motorola, Gillette, Braun, Siemens, Kodak, Seagate, Maxtor and Elcoteq. It has a total of 16 manufacturing plants, 13 in China (Shanghai, Chengdu, Xiamen, Tianjin, Qingdao, Suzhou), 2 in Singapore and another in Mexico.

Summary

Hi-P International Limited, together with its subsidiaries, is engaged in the design and fabrication of mold (MDF), precision plastic injection molding (PPIM), assembly, provision of ancillary value-added services (mainly surface finishing services) and precision metal stamping. The Company's subsidiaries are engaged in the manufacture of molds, manufacture of plastic injection parts, manufacture of camera products, spray painting, manufacture and sale of plastic product modules, manufacture of molds and related appliance plastic components, manufacture of metal precision components, provision of engineering support services, international sales and marketing activities, manufacture and production of in-mold decoration lenses, design and sales of electro-mechanical components, and manufacture of precision-stamped metal components and precision tools and die design and fabrication.