Author: Soon Fong

Who is 2nd Chance?

BACKGROUND

The Group started out as a sole proprietorship in 1975, when Mohamed Salleh set up Second Chance Enterprises to engage in the tailoring of men's garments. By 1976, the business had expanded to 3 tailoring shops. However, due to difficulty in expanding the tailoring business further, Second Chance Enterprises decided to switch to retailing of men's ready-to-wear fashion clothes in 1979.

In 1993, the Group opened its goldsmith shop, called Golden Chance Goldsmith. The gold jewellery retail business is currently the main revenue and profit contributor to the Group. In 1996, the Group expanded its gold jewellery retail business into Malaysia.

The Company was incorporated on 7 July 1981 as Indonesian Mercantile Traders (S) Pte Ltd. It changed its name to Second Chance Enterprises Pte Ltd in 1986 and to its present name in 1987 to reflect its change of status to a public limited company.

The Group is principally engaged in the retailing of ready-made wearing apparel, and gold and diamond jewellery, through a network of retail outlets in Singapore and Malaysia. Its 2nd Chance and First Lady outlets retail mainly the 2nd Chance brand of boys and men's clothing, and the First Lady brand of traditional Malay ladies' and girls' clothing respectively, while its Golden Chance outlets retail gold and diamond jewellery. In 1999, it diversified into property investments.

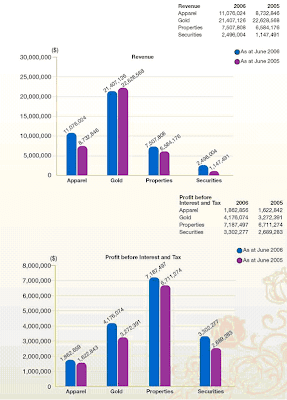

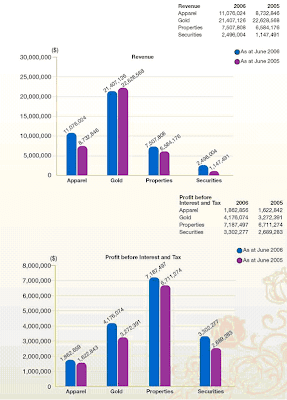

Business Review for FY2006

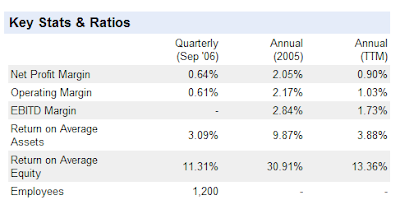

As we can see from the profit contribution breakdown, the main contributor is from properties segment which is 43.5%. Rental income was S$6.7 million or 40% of group’s profit before tax.

Apparel ( which many think that it was the main business ) contributed the least or 11.2%. Gold contributed 25% of the earning.

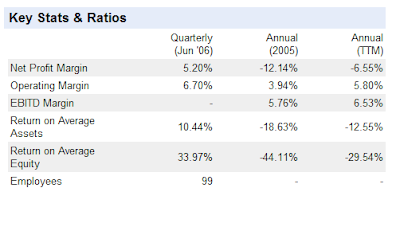

All the 3 segments are enjoying high profit margins as seen in the table above. And I believe the diversity in the business of 2nd Chance is bringing more profits to the company.

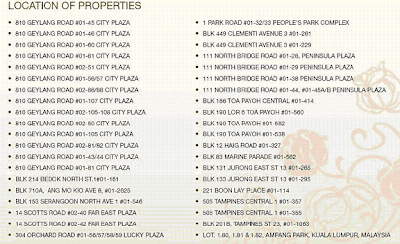

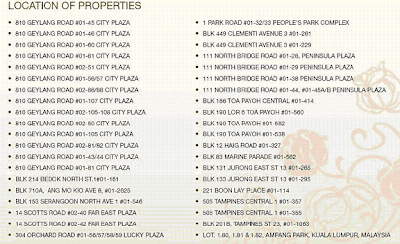

Breakdown of its Properties Why so many properties in City Plaza?

2nd Chance is aware of the condition and perception of many towards City Plaza (CP). There are 2 (two) compelling reasons for their purchases in CP. The government that owns Tanjong Katong Complex (TKC) have informed all tenants that this site is earmarked for redevelopment. Their tenancy agreement now includes a clause to vacate premises within 3 months of notice.

All retail profits from gold and apparel business in Singapore comes from our shops in TKC. The other 150 tenants in TKC will also be affected and when the time comes theytoo will be looking for premises hoping to rent or buy nearest to TKC. CP being just across the road, rentals and capital values of its shops is expected to enjoy a big increase when this expected new demand materialise.

It should be noted that any new development will take about 4 years to complete and its rental will be more in line with other suburban shopping centres like Parkway Parade, Tampines Square etc., whose present rentals are 3 to 4 times that of the rentals in CP.

Due to the declining popularity of CP, 2nd Chance had purchased 22 shop units there at depressed prices and expect to greatly benefit in the near future from the expectedincrease in rentals and capital values apart from having ready premises for retail businesses to relocate.

So how much does these assets worth?

The investment properties are stated at directors’ valuation carried out on June 30, 2006. The last independent professional valuation carried out by Jones Lang Lasalle Property Consultants Pte Ltd as at 30 June 2005 on the basis of open market valuation for existing use. It is the Group’s policy to revalue its investment properties at least once in every three years.

Based on the latest revaluation, all the properties are worth S$84 million.

Financial position at end 2006

The Group’s total assets stood at $126.6 million of which $84.7 million consisted of investment properties. Apart from these, the properties, which are self-occupied, amounts to $9.76 million. The Group held $19.95 million of quoted securities including REITS.

The Net current assets position as at end 2006 was $10.94 million and current ratio was

1.53 as compared to $6.81 million and 1.35 respectively in 2005. The increase was due to valuation of securities held for trade at fair market price as per FRS 39 guideline.

The shareholders’ funds were $71.81 million as compared to $58.05 million in 2005. The increase is attributable to the year’s net profit and increase in share capital. The net asset value per share was accordingly, 28.32 cents as compared to 31.78 cents in 2005.

What’s interesting about 2nd Chance?

Dividends Due to the steady growth of the Group a first and final dividend before tax of 20% or 3.0 cents per share, has been proposed for 2006. This is a 20% increase compared to the 2.5

cents per share dividend before tax for last year.

The dividend net of tax of 20% will amount to 2.4 cents per share or a total of $6.08 million on the existing issued capital as at 30 June 2006 giving a payment ratio of about 57.8%.

The Company has an estimated $2.31 million of section 44 credit available for franking the dividend and expect to fully utilise the Section 44 credit before the end of the transitional period in 2007, subject to the availability of profits for distribution.

Also 2nd Chance also announced a dividend of 2.7 cents for FY07 and 3.0 cents for FY08. These figures are attractive as they represent close to a 10% yield annually for the next 2 years and it excludes any further capital gain in the share prices.

Accompanying that, the board also intends to announce dividend for FY09 in FY07. This will give shareholders a chance to know their long term rewards from 2nd Chance and represent the confidence of 2nd Chance.

Earning per share is 3.96 cents on a diluted basis, and this represents a 7.32 times P/E ratio with a share price of 29 cents. This is an attractive figure, as property firms are trading at an higher P/E ratio.

NTA was 28.32 cents, this mean that buying the share at 29 cents represent no premium over its asset. With a high profit margin in its businesses, I do expect share price to be trading at 1.3-1.5 times over its asset or 36.8 cents-42.5 cents.

My personal take is buy for long term with a target of 36 cents to 42 cents with a annual yield of 10%.

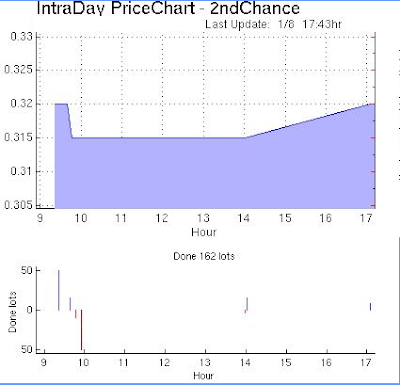

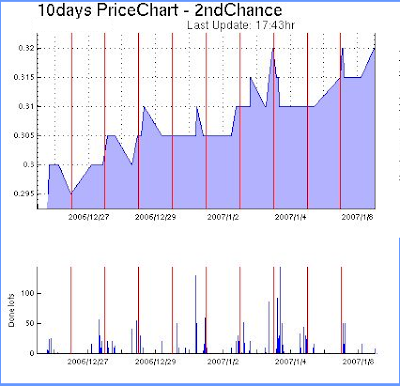

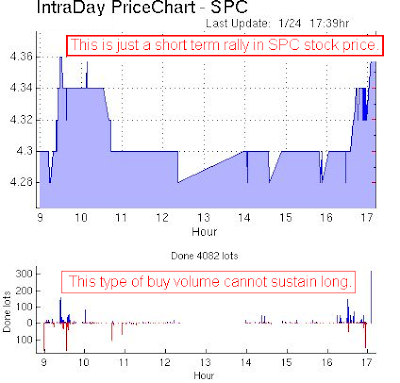

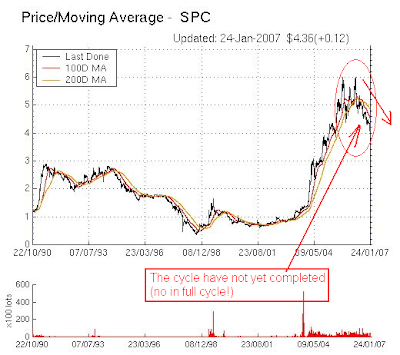

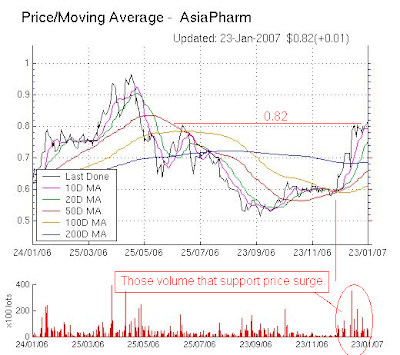

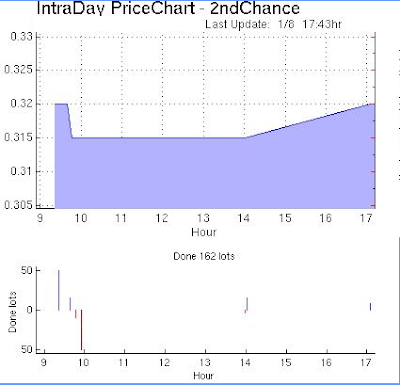

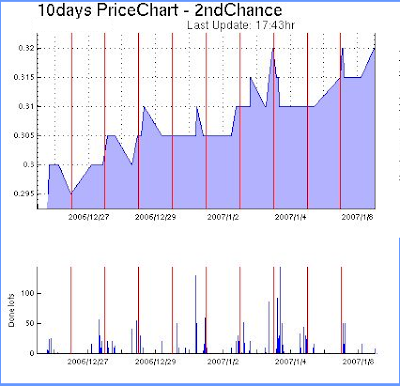

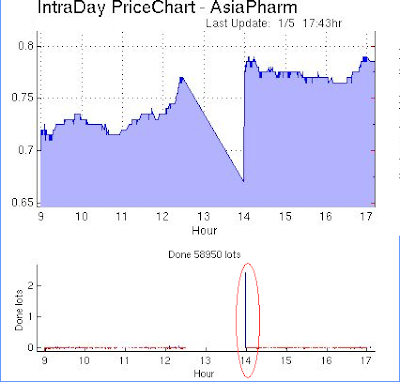

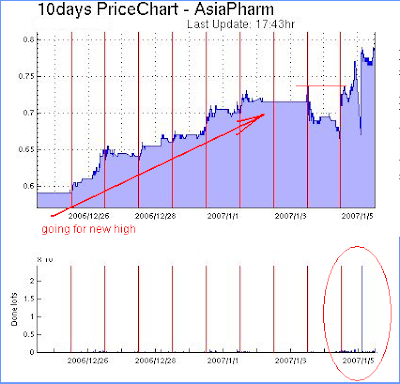

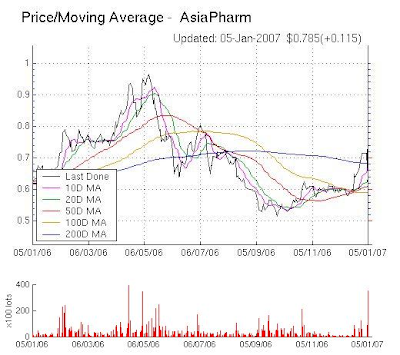

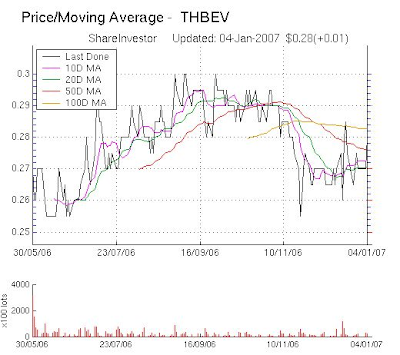

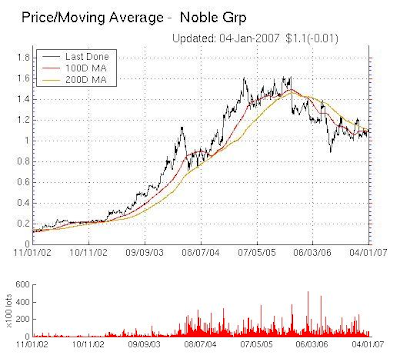

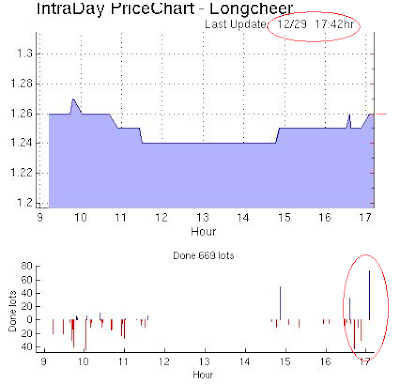

Price Chart on 2nd Chance.