Hi reader, catch those summary point for AP Oil, those summary will be your guide in your investment. I have try my best to write everythings that I know.

Hi reader, catch those summary point for AP Oil, those summary will be your guide in your investment. I have try my best to write everythings that I know.

环球石油集团去年全年取得690万元的净利,扭转了前年的亏损情况。

集团去年的收入激增41.8%,达6550万元。其中3550万元来自贸易;1896万元来自制造;1085万元来自特许经营。每股盈利报5.29分。集团每股净有形资产跃高72.8%至12.89分。

脱售AP石化(越南),使得环球石油集团获得一笔995万元左右的现金。

由于业绩好转,同时为了奖励长期支持集团的股东,它拟以每四股给一股的比例,派发红股。

环球石油往后将有四个增长策略:-一、在现有的市场增加宽度和深度,包括越南、中国和印尼;二、开拓新市场——印度、巴基斯坦、斯里兰卡和非洲;三、特许经营,希望在印度半岛和中东把最成功的孟加拉特许经营模式加以复制应用;四、合并与收购。

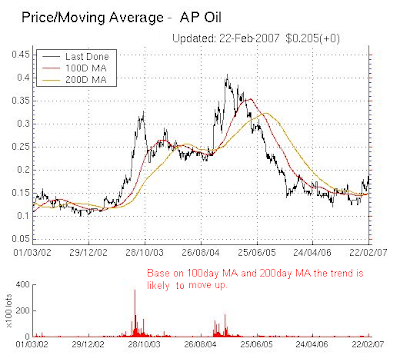

AP OIL International last year had made a net profit of $6.9 million, reversing the previous year's loss.This also back in the black for its 2006 financial year.

The lubricant and chemical specialist announced yesterday a net profit attributable to equity-holders of $6.97 million for FY2006, against a loss of $5.56 million for FY2005. Earnings per share came to 5.29 cents.

AP Oil has proposed a bonus issue of one new share for every four existing shares.

It attributed the turnaround to higher revenue, which grew 41.8 per cent to $65.48 million; better gross margins for its core businesses; and a $4.9 million extraordinary gain from the sale of its subsidiary AP Petrochemical Pte Ltd, which owned 80 per cent of AP Petrochemical (Vietnam) Co Ltd.

AP Oil Future growth strategy will be four of them:-

1.) Increase the breadth and depth of the existing market, including Vietnam, China and Indonesia.

2.) Opening up new markets -- India, Pakistan, Sri Lanka and Africa

3.) Franchising, in the Indian peninsula and the Middle East Bengal the most successful franchise model to replicate application.

4.) Mergers and acquisitions.

AP Oil International Limited is a Singapore-based company engaged in the manufacture of lubricating oil, import and export of oil and fuel, dealing in paraffin wax, lubricating oil and grease, and investment holding. The Company's business segments include manufacturing, trading, and franchising and outsourcing. The manufacturing segment manufactures a range of lubricating oils and fluids, and specialty chemicals for industrial, automotive and marine applications, and provides blending services to its customers. The trading segment trades in base oil and additives, and specialty chemicals. The franchising and outsourcing segment trades in base oil and additives using the Company's brand name. AP Oil International Limited's sales are mainly to South East Asia, Indo-China, East Asia and other countries. AP Oil International Limited has formed a joint venture company in the Philippines, AP Tang Mining (Phil) Corp.

Hi reader, catch those summary point for AP Oil, those summary will be your guide in your investment. I have try my best to write everythings that I know.

Hi reader, catch those summary point for AP Oil, those summary will be your guide in your investment. I have try my best to write everythings that I know.