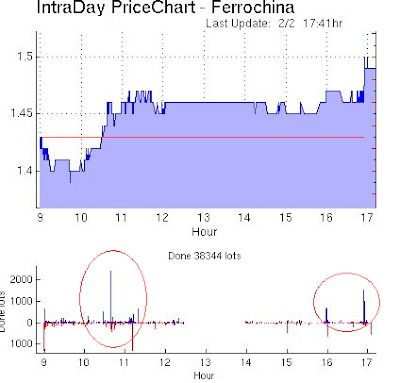

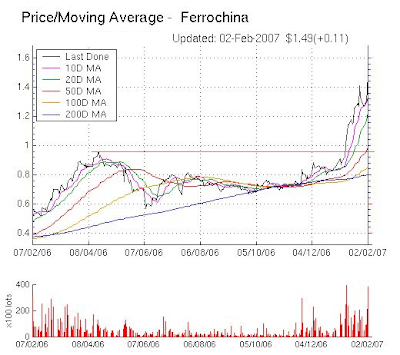

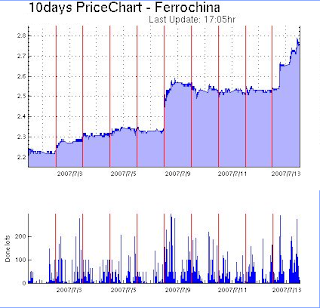

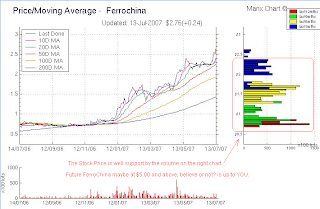

Good stock to be introduce - FerroChina.

The stock that I going to introduce is FerroChina, this is not a China company, why is it so?

Because they are a group of people that are expert in Galvanized steel making that are from Taiwan. They are using a fairly cheaper method of manfacturing and enviromental friendly way to produce masses tonnes of Galvanized steel, They claim that they are the leading Galvanized steel maker in China. Galvanized steel is very potential in China, because they are cheaper to be purchase by common China people to used the Galvanized steel for building of their house, this is the recent China housing building method as they use, China have phase out the old method of building their house. And in the coming future China will have many major big events that needed Galvanized steel as the structure of building, like Beijing 2008 Olympic Games and other many..etc.

This is the part of the story of FerroChina started in China:-

In Oct.2003, the company's Board of Directors decided to increase the total investment by US$22,500,000 to bring in another hot-dip galvanizing line with the design annual production capacity of 400,000 tonnes (i.e. Stage2 of the Project). Total increased investment capital in phase Ⅲ is USD 60.2 million, the design annual production capacity of phase Ⅲ is 400,000 tonnes. And increased registered capital is USD 30.88million.The land square is 150 mu(i.e. 100050 m2 ).

Now Changshu Xingdao Advanced Building-Material Co., Ltd is fully owned by Ferrochina Limited, which is incorporated in Bermuda .

With the aim to obtaining the greatest value for all involved parties by means of strengthening economic co-operation, technical communication guided by the win-win strategy ,the company will frankly cooperate with its partners, suppliers and customers and continuously upgrade the quality of the products through application of advanced foreign equipments and technologies. Meanwhile the company will give more attention to protect the environment. More energy will be spent on exploiting the foreign advanced building-material markets and satisfying the needs of our various customers. All employees of the company will sincerely act on the policy of team sprit, continuous improvement, innovation and value creation and continuously pursue the state of super excellence. The company will make great effort to promote the local economy through hard working. The company will also actively take part in and promote the development of local society's culture, education, medical care system and social welfare.

They are from the FerrorChina website:-

The History http://www.ferro-china.com/history.asp

http://www.xing-dao.com/en/lsyg.asp

http://www.xing-dao.com/en/scsb.asp

Investor http://www.ferro-china.com/investor.asp

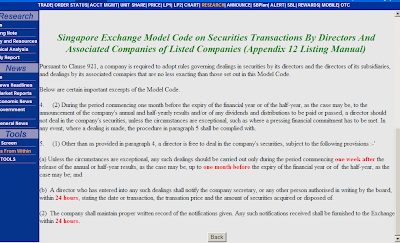

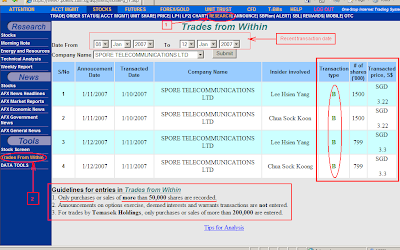

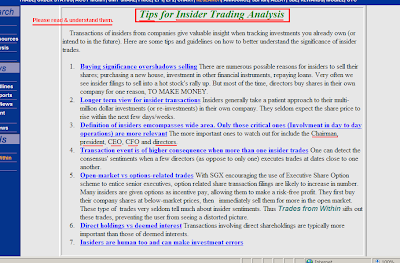

Inside trading http://www.ferro-china.com/investor.asp

The FerroChina Video Steaming. (This will make you more confident in FerroChina)

Corporate Video Click here to download

IPO Launch Video Presentation http://ss1.shareinvestor.com/ir/ferrochina/ipo_launch/index.htm

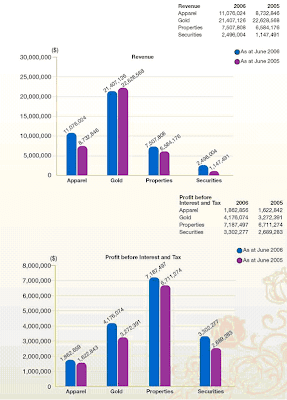

1HFY2005 Results Presentation http://ss1.shareinvestor.com/ir/ferrochina/1h05/index.htm

1HFY2006 Results Presentation http://ss1.shareinvestor.com/ir/ferrochina/1hfy2006/Web/Script/index_IE.htm

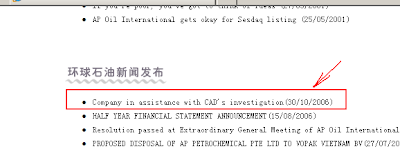

newspress http://www.listedcompany.com/ir/ferrochina/newsroom/newsroom.cgi?